In the fall of 2018, Tencent and WeChat launched their own similar product, LingQianTong (or “Mini Fund”). By March 2019, the Tianhong Yu’e Bao fund (which translates to “leftover treasure”) had about 588 million clients, 1/3 of the Chinese population. AliPay launched the Tianhong Yu’e Bao Money Market Fund (which basically amounted to a high-yield checking account) for users in 2013 and by 2017, it was the largest money market fund in the world, surpassing offerings from JP Morgan, Fidelity, and Vanguard. To illustrate how big the Chinese FinTech market is, look no further than WeChat Pay’s most direct competitor, AliPay by Ant Financial (Alibaba).

#Wechat out code#

WalkTheChat estimates what the WeChat Pay growth looks like over time:īesides the QR code payments that WeChat is well known for, they also offer FinTech products that include wealth management, consumer lending, insurance, and remittances, among many others. Six years later, in 2019, FinTech offerings drove $11.9 billion (22% of) Tencent’s total revenue. They don’t break out payments from “FinTech” and “business services” in their financial statements, but I am going to imagine they have a set up like Apple Wallet where they take a small fee on transactions (e.g., 0.15%) that otherwise would have gone to the banks/card issuers. It’s actually a bit fuzzy where Tencent makes money on WeChat Pay. One way to think about WeChat mini-programs and their apps is that they’re storefronts built on top of a payment app, rather than a payment experience build into a website. In Q4 2019, WeChat pay was doing more than 1 billion commercial transactions/day across its 800 million monthly active users and 50 million merchants.

#Wechat out update#

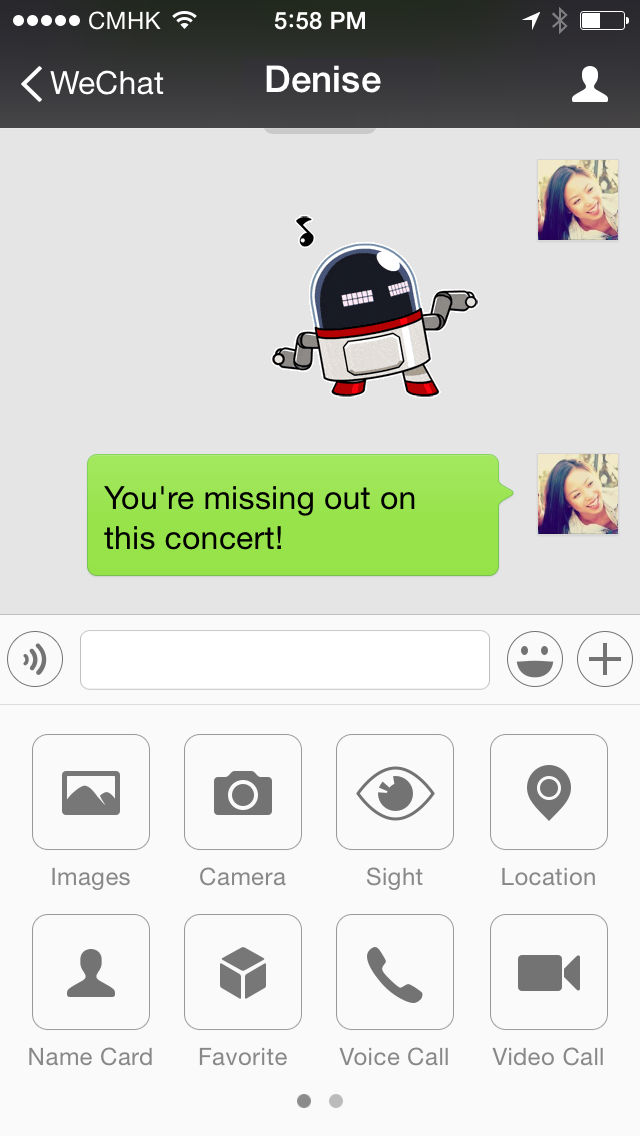

In that same update (WeChat Version 5.0) WeChat added payments and the ability to buy stickers (one of their first monetization attempts).

In my last post, I proposed that WeChat began morphing into a true “Super App” at the point where it added official accounts (a pre-cursor for mini-programs) in May of 2013. This is part of a larger thesis on Super Apps that I’ll talk about in my next post. Aside from this international calling feature, WeChat launched its mobile wallet - which has 200 million users in China - in South Africa, the same country where it just unveiled a $3.4 million fund for investing in local startups.To be a truly generalizable Super App, I believe you need to own your user’s wallet. For a while it seemed like the company had stopped pushing the app overseas but it has increased its internationalization of late. Tencent doesn’t break out its user numbers for WeChat based on location, but we can assume that the majority of its active users are based in China, where WeChat is the default mobile messaging app used by people of all ages.

#Wechat out free#

WeChat did launch an standalone international free calls app back in 2014, but that service hasn’t set the world alight. Skype, of course, pioneered the concept while Line - another popular messaging app in Asia - added its own version nearly two years ago. The service is known for being hugely innovative in China, but it is relatively late to the international calling area. (Those with the calling feature enabled can look prices up inside the app as explained here.)

WeChat, which is owned by Chinese Internet giant Tencent, is gifting its users an initial $0.99 in credit (which it says will allow up to 100 minutes in calls) to get things started, although it hasn’t revealed the cost of calls once that freebie has been eaten up. ‘WeChat Out’ is different from the existing calling options inside WeChat (voice and video) because it allows for calls to actual phone numbers (mobile and landline) rather than just to fellow WeChat users. The service is initially available for users based in the U.S., Hong Kong and India, but it will roll out to others over time. WeChat, the Uber popular Chinese message app with more than 500 million active users, is taking a leaf out of the Skype playbook after it launched an international telephone calling service.

0 kommentar(er)

0 kommentar(er)